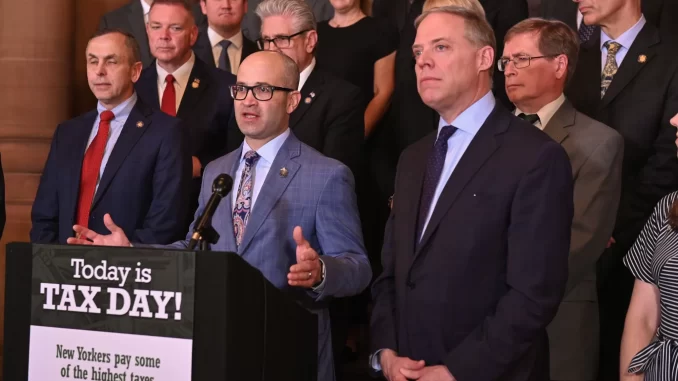

By Ed Ra

It’s no surprise New York is once again ranked last in terms of our tax environment. New Yorkers pay some of the highest taxes in the country and contend with an outrageously high cost of living, and we consistently come in last for our business climate. These factors lie at the heart of the problem in New York — it’s simply unaffordable.

Only 1.6% of taxpayers contribute nearly half of the state’s personal income tax collections, a group we heavily rely on. During economic downturns, this reliance can severely impact our revenues and budget. Despite this, our majority colleagues propose doubling down on taxing this group to sustain their spending dreams. Despite previous claims of “temporary” tax increases, both majorities are proposing to raise top income tax rates again this year, reaffirming that tax hikes are rarely “temporary.”

“To reverse this troubling trend, we must prioritize fiscal responsibility with taxpayer dollars. I proudly endorse legislation enhancing budget transparency, curbing spending, fortifying reserves and reducing long-term debt, which would help ease the burden on our taxpayers and make New York a more affordable, economically stable and friendlier place to live and work.”

Ed Ra (R-Franklin Square) represents the 19th Assembly District, which consists of Nassau County, including parts of the towns of Hempstead and North Hempstead.