Residents have a right to know how much their taxes are going up in their school budgets.

There is a requirement that school districts provide notice to their residents of upcoming school budget votes.

The notices show the spending amounts, and even the percentage of the spending increases from the previous year.

But they may not show the total number of extra dollars a taxpayer will pay if the budget passes or what the percentage increase in the tax levy will be.

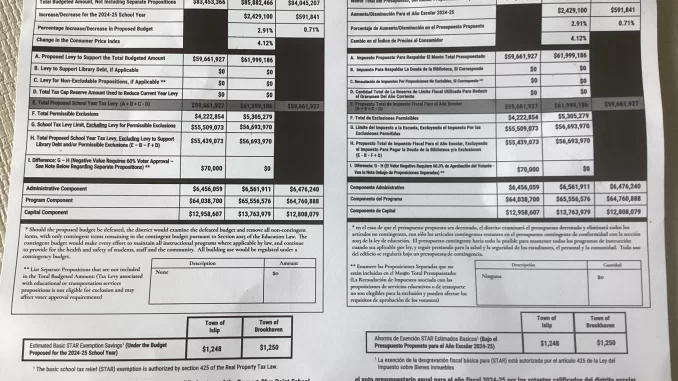

Take, for example, the recent notice sent out by the Bayport-Blue Point School District to its residents. It says that the budget is within the state’s cap and mentions that there’s a 2.9% increase in spending.

Nowhere in the notice, however, is it stated that the actual tax increase to the average homeowner will be closer to 4%.

It does show that this year‘s levy is $59,661,927 and that next year‘s will be $61,999,186. But that does not give the average taxpayer an idea how much extra they will individually be paying for next year‘s budget if it is passed. Taxpayers should not have to do the math to find out the percentage increase.

Check out the actual notice sent. Note how it shows the spending increase percentage, but not the tax levy percentage. It juxtaposes the 2.9% spending increase to the 4.1% CPI increase, making it appear that the school came in well below the CPI. But that’s not the case with the actual taxes paid, which is the levy. The total tax levy amount on Line A does not show a percentage increase, which was closer to 4%, as opposed to the 2.9% related to spending.

State legislators should address this to ensure that notice be given so residents can get a quick idea of the percentage tax increase that they’ll be paying.

The residents may feel quite comfortable paying that. That’s an individual decision for each homeowner. But they should have the information as to what they will actually be paying so that they can make an informed, intelligent decision.