By Hank Russell

Soon after signing the state budget, Governor Kathy Hochul came to Farmingdale State College on May 13 to announce that she is bringing economic relief to Long Island families. But some wonder if this would really help Long Islanders, who are already financially overburdened.

The FY 2026 State Budget includes Hochul’s plan to give 215,000 Long Island families an annual tax credit of up to $1,000 per child under age four and up to $500 per child from four through sixteen. This is the largest expansion of New York’s Child Tax Credit in its history — benefiting approximately 355,000 children on Long Island, according to Hochul.

The budget also includes Hochul’s plan to cut taxes for more than 80 percent of all tax filers on Long Island. This will deliver nearly $168 million annually in tax relief to 1.2 million Long Islanders — bringing taxes for the middle class to their lowest level in 70 years, said Hochul. Additionally, New York’s first-ever inflation refund checks totaling $316.4 million will be sent to almost 1.3 million Long Island taxpayers.

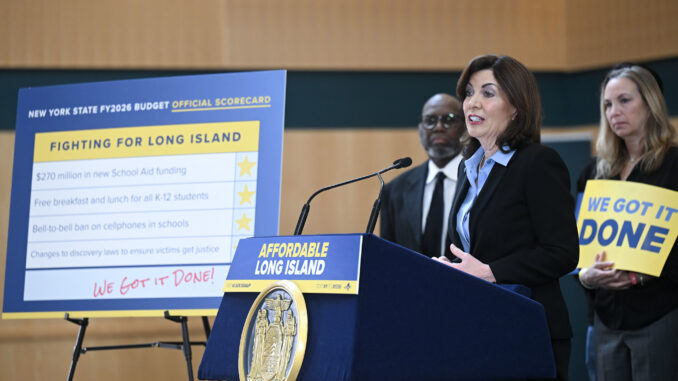

Hochul said she also secured more than $270 million in additional state aid for Long Island school districts for the 2025–26 academic year — a 5.4 percent increase over the current year.

In addition, Hochul announced she has made investments to the region’s environment. Among them:

- $1.7 billion for the State’s share of the Fire Island to Montauk Point (FIMP) project — a federal-state-local partnership representing a once-in-a-generation investment in Long Island’s long-term flood resilience.

- A record $425 million for the Environmental Protection Fund, including $17.15 million specifically for Long Island programs that protect groundwater and preserve the island’s unique environment.

- Continued $500 million statewide investment in clean water, with Long Island receiving more than $458 million in water infrastructure funding in the past four years.

- An additional $8.75 million for the Blue Buffers Voluntary Buyout Program, which supports resilient shorelines and protects vulnerable Long Island homes from future flooding.

“The cost of living is too damn high for Long Island families, so I promised to put more money in your pockets — and we got it done,” Hochul said. “Putting thousands of dollars back in the pockets of families means helping Long Islanders afford the rising costs of groceries, raising kids, and just enjoying life. When I said your family is my fight, I meant it – and I’ll never stop fighting for you.”

Some of the state legislators supported the governor’s economic plan.

“The expansion of the child tax credit will alleviate the rising cost of childcare for countless families across Long Island, and tax cuts for the middle class is a hallmark of this year’s budget,” said Assemblyman Tommy John Schiavoni (D-Sag Harbor). He also said the increase in school funding “signal[s] the state’s commitment to address affordability and its support of public schools.”

“The affordability crisis has hit Long Islanders hard, and while there is still much more work to be done, I believe this budget does an excellent job at tackling the crisis head-on,” Schiavoni said.

“Governor Hochul’s economic plan is exactly the kind of relief Long Island families need right now,” Assemblyman Charles Lavine (D-Glen Cove) added. “By expanding the Child Tax Credit and cutting taxes for more than a million middle-class residents, she’s helping parents keep up with the rising cost of living and putting money back in the pockets of hardworking New Yorkers.”

Assemblyman Keith Brown (R,C-Northport) said that, while the expansion of the Child Tax Credit and tax cuts are “positive steps that will provide much-needed relief to families struggling with the high cost of living,” and “smart, targeted measures that can make a meaningful impact in our region,” he said the inflation rebate checks are “not a long-term solution” since it’s only a one shot.

“What Long Islanders really need is sustained structural relief, lower property taxes, affordable housing and reduced energy costs,” Brown said. “If we want to keep families and businesses here, we need to focus on comprehensive reforms that address the root causes of affordability. I’m committed to working with my colleagues to ensure Long Island families have the support they need not just today, but for the long haul.”